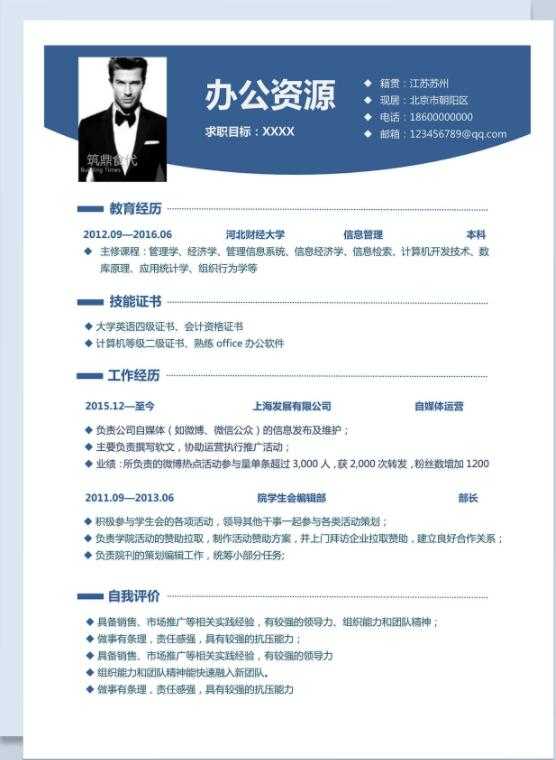

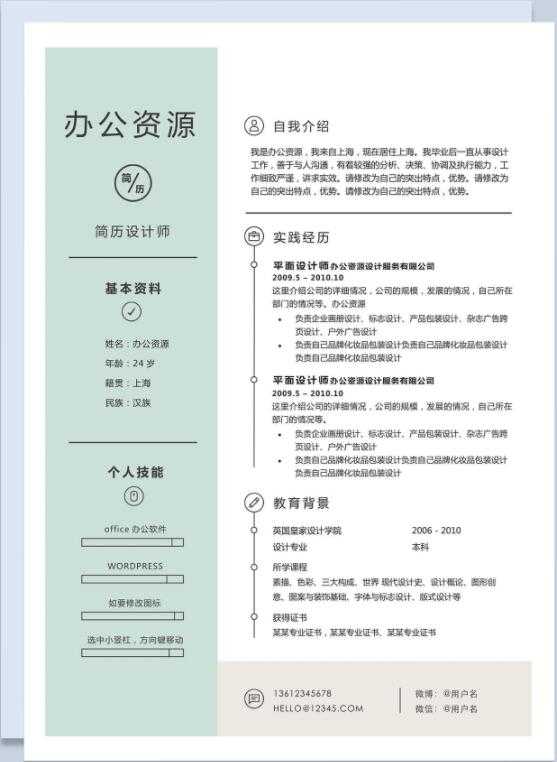

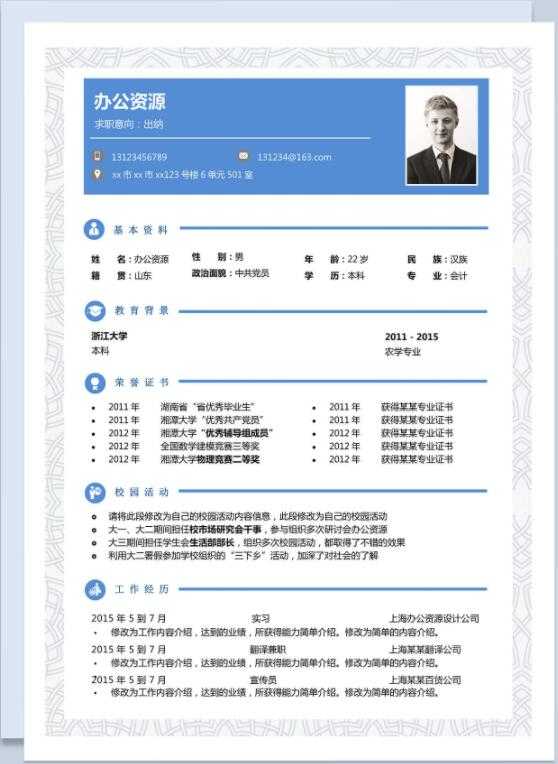

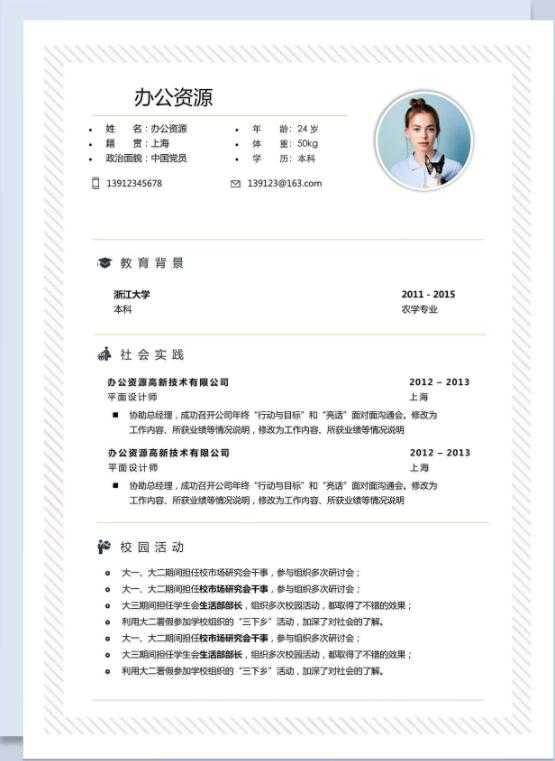

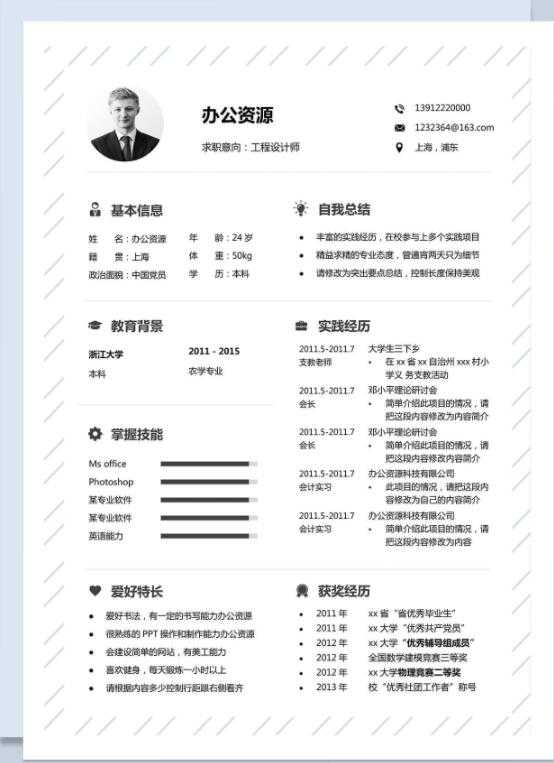

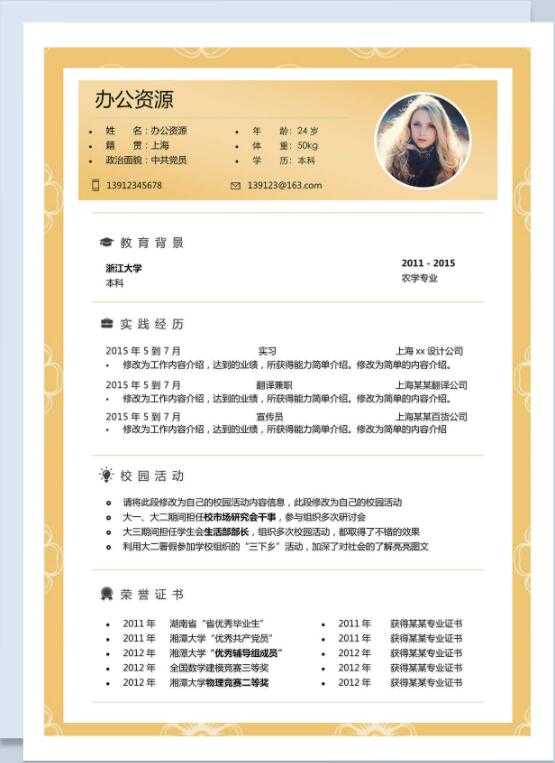

我们都知道,求职面试找工作要有一份简历,一份漂亮大气的简历能让面试官眼前一亮,会给你加分不少,而下面小编又来分享福利了,想要的赶快来哦,七天免费领取。(文末注明领取方式)

以上就是今天给大家分享的几款Word简历模板了,这些模板都来自于“办公资源”网站,想要获得更多资源的请关注小编哦,每天给你带来不一样的惊喜。

注意事项:

不要在微信、知乎、QQ、内置浏览器下载、请用手机浏览器下载! 如果您是手机用户,请移步电脑端下载!

1、文稿PPT,仅供学习参考,请在下载后24小时删除。

2、如果资源涉及你的合法权益,第一时间删除。

3、联系方式:zhaokezx888@qq.com

PPT网 » 分享一波优质Word简历模板,赶快来领

不要在微信、知乎、QQ、内置浏览器下载、请用手机浏览器下载! 如果您是手机用户,请移步电脑端下载!

1、文稿PPT,仅供学习参考,请在下载后24小时删除。

2、如果资源涉及你的合法权益,第一时间删除。

3、联系方式:zhaokezx888@qq.com

PPT网 » 分享一波优质Word简历模板,赶快来领