Word是我们日常办公中经常使用的软件,所以想要提高办公效率就有必要掌握一些Word的小技巧了。那下面我们就来看看Word中有哪些好用的小技巧吧。

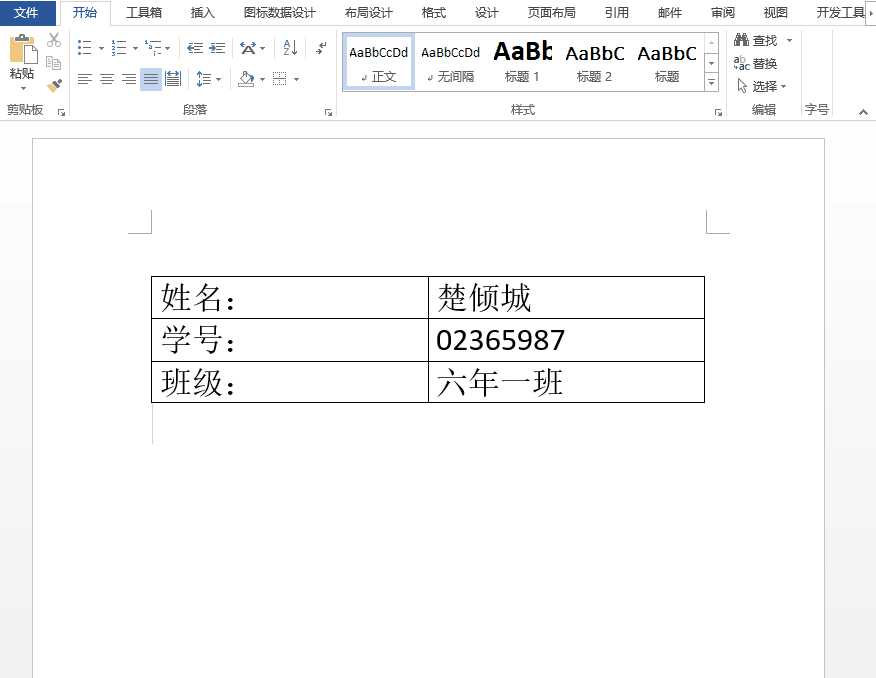

1、快速添加Word封面的下划线

操作:插入一个表格,输入数据;选中整个表格,点击【开始】,选择【无框线】;选中最右一列的表格,点击添加【下框线】,再点击添加【内部横框线】即可。

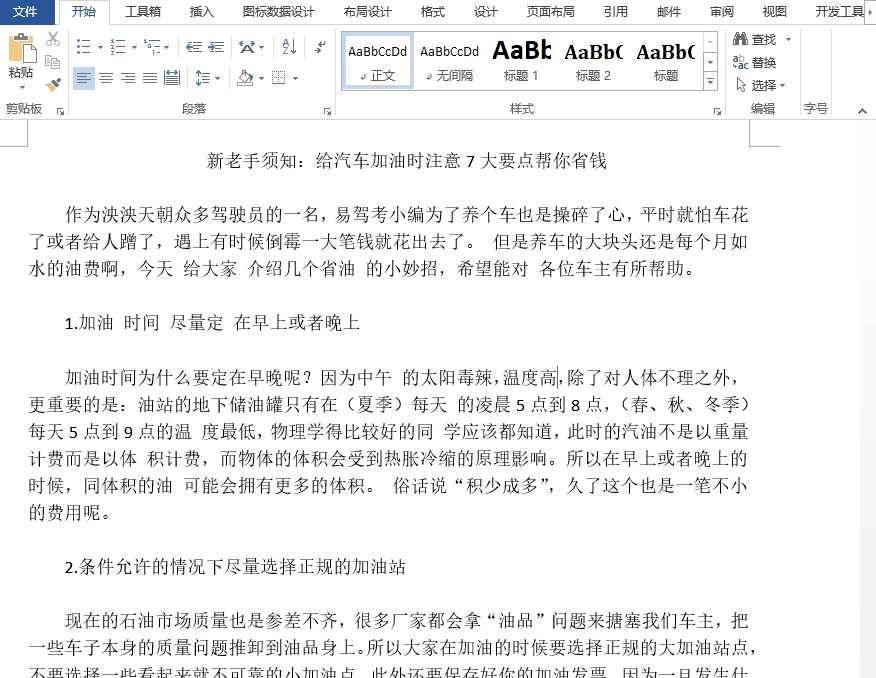

2、快速删除多余空格

操作:点击【开始】,点击【替换】,弹出【查找和替换】窗口,在【查找内容】的编辑框中按一下【空格键】,点击【全部替换】按钮,点击【确定】即可。

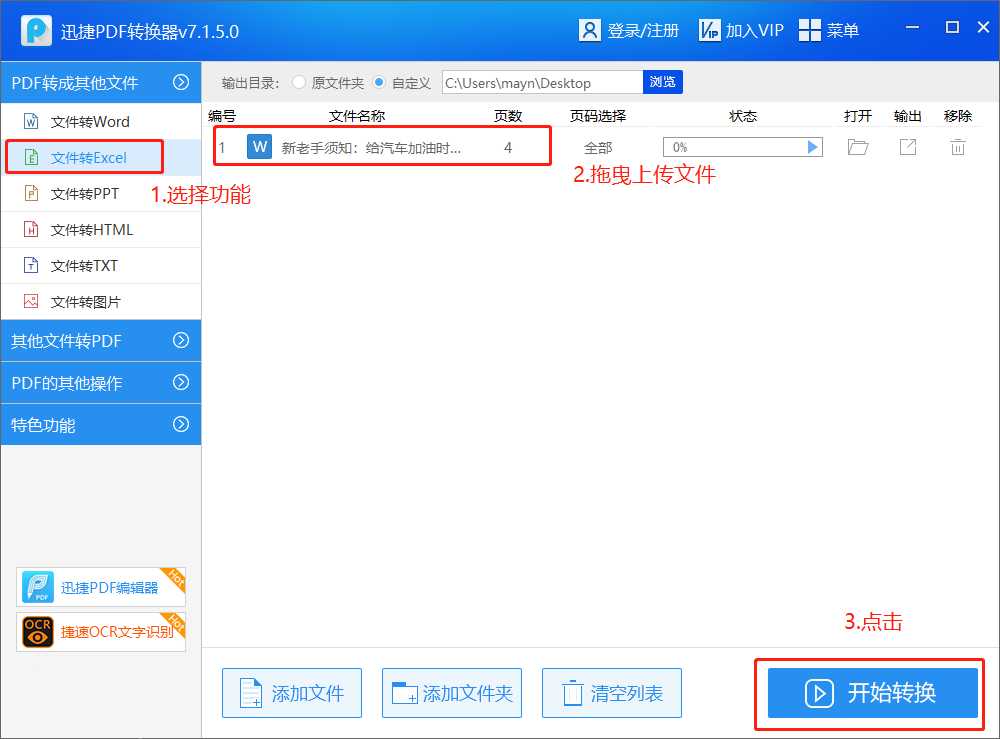

3、快速把word文件转为excel文件

操作:打开【迅捷PDF转换器】,选择【文件转Excel】,拖曳上传文件,点击【开始转换】即可。

4、快速插入特殊线条

操作:输入【~~~】,再按回车键,即可成为波浪线;输入【—】,再按回车键,即可成为横线;输入【===】,再按回车键,即可成为双横线;输入【***】,再按回车键,即可成为点线。

以上这些Word的小技巧你学会了吗?如果你有更多、更好的Word小技巧欢迎在下方留言分享!大家一起学习学习!

注意事项:

不要在微信、知乎、QQ、内置浏览器下载、请用手机浏览器下载! 如果您是手机用户,请移步电脑端下载!

1、文稿PPT,仅供学习参考,请在下载后24小时删除。

2、如果资源涉及你的合法权益,第一时间删除。

3、联系方式:zhaokezx888@qq.com

PPT网 » 一分钟学会4个Word文档常用的技巧,准时下班再也不是奢望了!

不要在微信、知乎、QQ、内置浏览器下载、请用手机浏览器下载! 如果您是手机用户,请移步电脑端下载!

1、文稿PPT,仅供学习参考,请在下载后24小时删除。

2、如果资源涉及你的合法权益,第一时间删除。

3、联系方式:zhaokezx888@qq.com

PPT网 » 一分钟学会4个Word文档常用的技巧,准时下班再也不是奢望了!